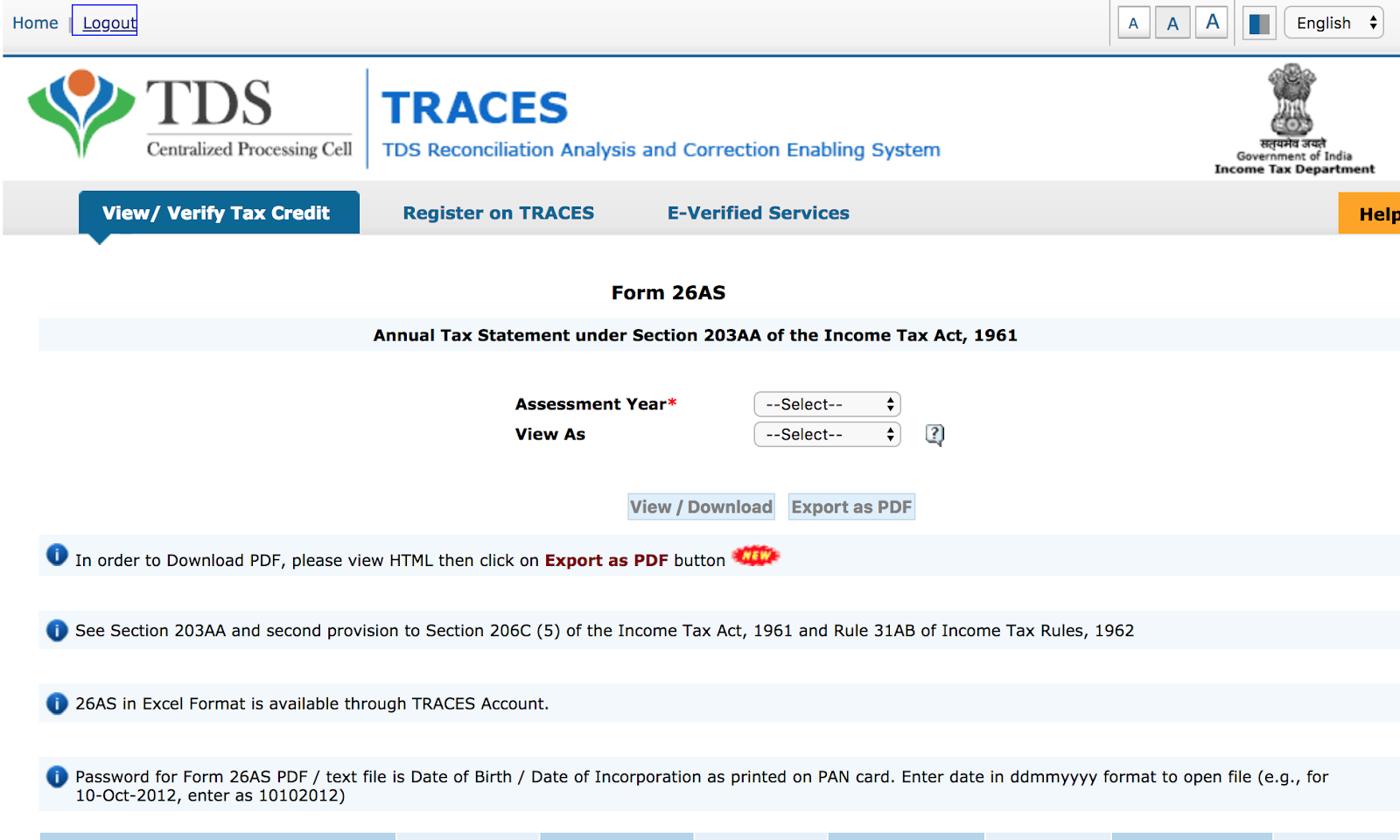

Step-by-step process to download Form 26AS The following banks allow you to view the form via net banking. on the TDS Reconciliation Analysis and Correction Enabling System (TRACES) portal.Īlternatively, the form can be viewed via Internet banking from Financial Year 2008–2009.

This form is issued under section 203AA of the Income Tax Act, 1961 and Rule 31AB. You may claim the tax deducted as shown in this form at the time of filing your Income Tax Returns (ITRs) for the relevant financial year. Moreover, the form shows details on any sale or purchase of immovable property, cash withdrawals or deposits from savings accounts, and mutual funds.

All this information is related to your Permanent Account Number (PAN). The Tax Credit Statement, also known as Form 26AS, is an annual statement that consolidates information about tax deducted at source (TDS), advance tax paid by the assessees with self-assessment tax, and tax collected at source (TCS). From November 2020, this statement includes details about special financial transactions, tax demands, completed and pending assessment proceedings, and refunds. It reflects the total tax paid to the Income Tax (IT) Department by you and much more. This Tax Credit Statement form is an important document for taxpayers.

0 kommentar(er)

0 kommentar(er)